Beginners Guide to Investing and 6 Typical Asset Allocation Profiles

Check out 6 typical asset allocation profiles and other topics our stock market for beginners guide to investing writes about on how to optimize you investment portfolio.

One of the most important things our stock market for beginners guide to investing will teach you is how to optimize you portfolio mix out of different asset classes helping you to achieve your financial goals. This varies from investor to investor, and will usually be determined by your investment risk profile, which discloses your attitude to safe investing.

No matter which of 6 available asset allocation profiles suites you the most, you have to be aware, that financial planning is a long-term process, and many investments that can be used to help achieve long-term financial goals are also long-term in nature. However, while long-term growth is generally achieved, it may come with periods of negative returns. To ensure your financial goals are reached, generally you must remain invested true to your financial plan during these periods.

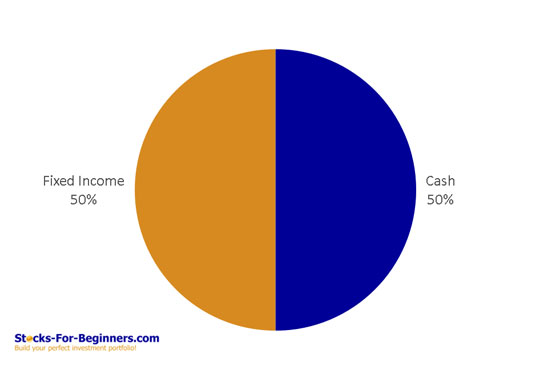

Beginners Guide To Investing - Capital Secure Asset Allocation

Suitable for:

- You have little or no understanding of the investment markets and their operation.

- When you think of the term risk, you think it means "very high danger".

- When you make a financial decision, you always focus on the possible losses.

- You seek basic returns and wish to take on a very low level of risk.

- With your present investment monies, you would prefer minimum exposure to risk.

Investment strategy and time frame:

- Recommended investment time-frame is less than 2 years.

- This investment portfolio is made up of around 100% defensive assets and 0% growth assets.

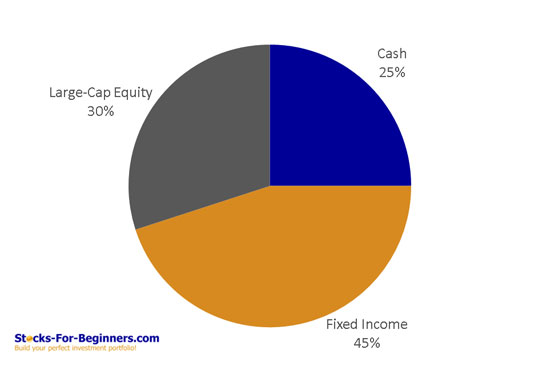

Beginners Guide To Investing - Conservative Asset Allocation

Suitable for:

- You seek to protect your capital and are somewhat concerned when this does not occur.

- You have a very basic understanding of the investment markets and their operations.

- When you think of the term risk, you think it means "danger".

- When you make a financial decision, you usually focus on the possible losses.

- You seek moderate returns and do not wish to take on more than a low level of risk.

- With your present investment monies, you would be comfortable taking very low risks and you are not very comfortable with the concept of risk.

Investment strategy and time frame:

- Recommended investment time-frame is from 3 to 5 years.

- This investment portfolio is made up of around 70% defensive assets and 30% growth assets.

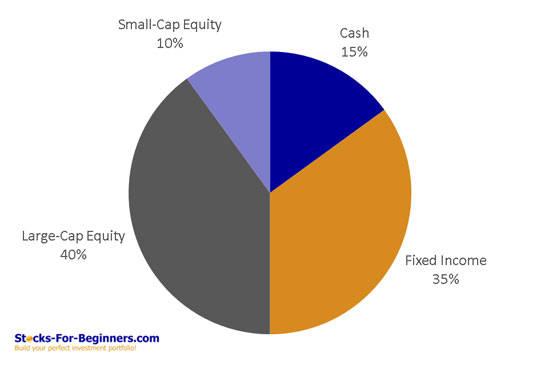

Beginners Guide To Investing - Moderate Asset Allocation

Suitable for:

- You have a general understanding of the investment markets, but would like to have a broader understanding in order to explore the possibilities.

- When you think of the term risk, you think it means "uncertainty".

- When you make a financial decision, you are more focused on the possible losses, but also keep in the mind the possible gains.

- You are prepared to accept a moderate level of risk volatility in the overall capital value of your investments.

- You are generally a low risk taker and are somewhat comfortable with the concept of risk.

Investment strategy and time frame:

- Recommended investment time-frame is from 5 to 7 years.

- This investment portfolio is made up of around 50% defensive assets and 50% growth assets.

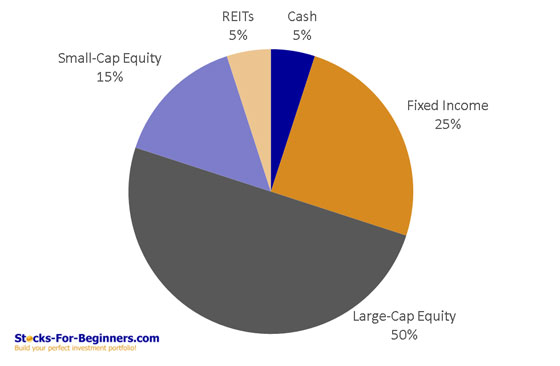

Beginners Guide To Investing - Balanced Asset Allocation

Suitable for:

- You have a reasonable understanding of the investment markets and their operation.

- When you think of the term risk, you think it means "possibilities".

- When you make a financial decision, you are more focused on the possible gains, but also keep in mind the possible losses.

- You can accept that there will be some level of volatility in the value of your investments.

- You are a moderate risk taker and can accept some moderate levels of investment risk.

Investment strategy and time frame:

- Recommended investment time-frame is from 7 to 10 years.

- This investment portfolio is made up of around 30% defensive assets and 70% growth assets.

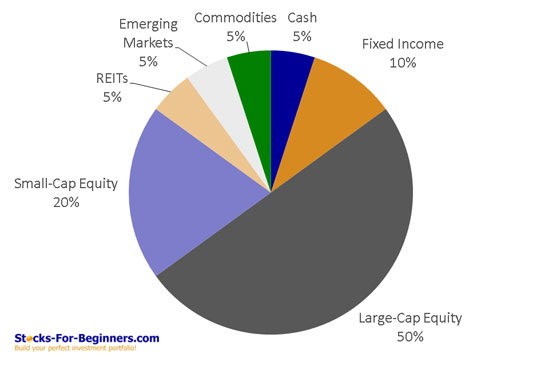

Beginners Guide To Investing - Growth Asset Allocation

Suitable for:

- You desire to invest in a broad spread of quality investments, but predominantly in growth assets to achieve higher growth.

- You understand that investment markets can and will fluctuate and that different market sectors offer different levels of risks, income and growth.

- When you think of the term risk, you think it means "opportunity".

- When you make a financial decision, you usually focus on the possible gains.

- You are a high risk taker and can accept higher levels of investment risks.

- You are seeking to achieve a reasonably high rate of growth on the capital invested.

Investment strategy and time frame:

- Recommended investment time-frame is 10 years or more.

- This investment portfolio is made up of around 15% defensive assets and 85% growth assets.

Beginners Guide To Investing - Aggressive Asset Allocation

Suitable for:

- You desire to invest strictly in growth assets to maximize long term capital growth.

- You understand that investment markets can and will fluctuate and that different market sectors offer different levels of risks, income and growth.

- When you think of the term risk, you think it means "very big opportunity".

- When you make a financial decision, you focus on the possible gains.

- You are a high risk taker and can accept higher levels of investment risks.

- You are seeking to achieve a high rate of growth on the capital invested.

Investment strategy and time frame:

- Recommended investment time-frame is 10 years or more.

- This investment portfolio is made up of around 0% defensive assets and 100% growth assets.

You can find some information regarding asset allocation also at our friend's website Stockexchangesecrets.com.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Beginners Guide to Investing to How to Invest in Stock

Back from Beginners Guide to Investing to Best Online Trading Site for Beginners home page