Oil ETF Funds: USO, DBO, OIL and CRUD - Which One Is the Best to Invest In?

Oil ETF funds are often the most appropriate way to get exposure to volatile spot oil prices. But which ETF is the best?

Let me start this article with some basic information about crude oil market, which is necessary to understand before selecting appropriate instrument to gain exposure to crude oil prices. Retail investors, as you are probably aware of, cannot trade crude oil on the spot market, because they cannot produce, store and transport crude oil. Because there is no real spot market to trade oil, there is no instrument that would be able to directly track the spot price of this energy commodity. This is the main reason why all the instruments related with crude oil are better or worse approximation of spot price following.

A retail investor can get exposure to crude oil by investing in crude oil futures, which requires a special, margin account with your broker and advanced investing knowledge, or you can simply choose among available oil ETF funds. The latest possibility is just easing your life, while fund managers deal with the same problem, the lack of spot market and that is why they try to track spot crude oil price by investing in futures. And this is the most important characteristic to remember, since there is a high risk of contango (backwardation) with futures investing, resulting in possibility for huge tracking error of ETFs trying to track the spot crude oil prices.

Just to refresh your memory, the problem of contango with oil ETF funds happens because of the fact, that most of the time the price of crude oil that delivers in the next month is higher than the price of this month's future contract; this is known as forward curve. There are rare cases when situation is turned around. While oil ETF funds must periodically sell existing crude oil futures and replace them by buying future contracts expiring in a more distant month, they constantly keep losing some NAV because of contango effect.

Technical operation of rolling the futures can have a negative impact on fund's net asset value (NAV) also because of changes in spot price of crude oil and interests earned on cash not invested in the crude oil futures. Even if crude oil ETF funds employ leverage and therefore invest only a small portion of money in future contracts while leaving most of the capital in money market instruments, the rolling effect can have huge implications on fund's returns.

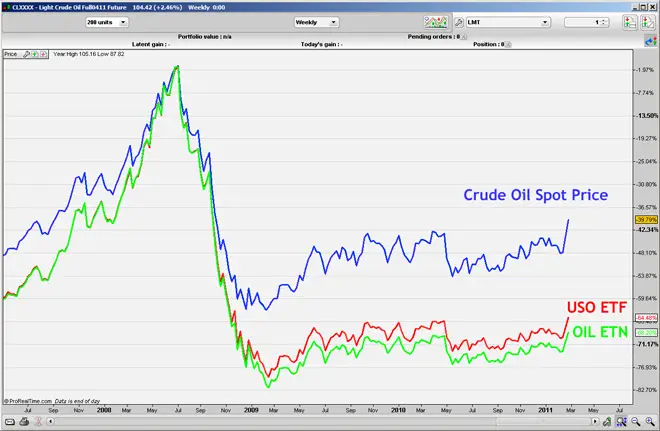

To illustrate the problem of rolling futures additionally, assume that spot crude oil prices rise 15% in one year, while there is a -20% roll yield. In this case, the ETF return would be negative (-5%) even if the crude oil spot price did rise for 15%. In case of backwardation, which is rare, oil ETF funds return would outperform the crude oil spot price. Something similar happened in 2010, when spot WTI surged by about 15% but USO's 2010 return was slightly negative.

While all the ETF fund managers deal with the problem of contango in its own way, I would like to mention another option to gain exposure to crude oil. These are ETN's or Exchange Traded Notes. We have written an article about investing in ETFs, where we also explain the difference between ETFs and ETNs. Just to refresh your mind, ETNs are debt instruments carrying additional credit/counterpary risk of the issuer to your investment.

Comparison of USO, DBO, OIL and CRUD

In the table below you can find the major differences between USO, DBO, OIL and CRUD.

| Ticker | Type | Contango Strategy | Expense Ratio | Assets (million) | Inception |

|---|---|---|---|---|---|

| USO | ETF | Passive | 0.45% | $2,000 | 04/10/06 |

| OIL | ETN | Passive | 0.75% | $877 | 08/15/06 |

| DBO | ETF | Active | 0.75% | $662 | 01/05/07 |

| CRUD | ETF | Passive* | 1.22% | $5.2 | 02/22/11 |

Source: Morningstar.com, 03/07/2011

Like already mentioned, the main difference between several investment instruments available for tracking spot crude oil price is about how they deal with the problem of contango.

Starting with USO (United States Oil Fund), their managers did not implement any special way of handling the contango risk. They are passive and simply roll out futures two weeks prior to expiration, while holding contracts with the nearest futures expiration because this strategy normally results in higher correlations to spot oil prices.

1 day

5 days

3 months

6 months

1 year

2 years

5 years

Max

OIL ETN is very similar to USO in managing contango risk. The main difference is in the rollover period. OIL does it about two weeks before front month expiration, but this probably doesn't have any significant economic effect. OIL is however an ETN, uncollateralized obligation by Barclays Bank PLC, which is a clear disadvantage compared to USO.

1 day

5 days

3 months

6 months

1 year

2 years

5 years

Max

DBO (PowerShares DB Oil Fund) utilizes an active strategy of mitigating the effect of rollovers on fund's returns. Managers have the possibility to maximize the roll benefits in backwardation markets and minimize the losses from rolling in contango markets. While active approach can be an opportunity for managers, it could also present an additional risk compared to passive approach used by USO, as with all financial things.

1 day

5 days

3 months

6 months

1 year

2 years

5 years

Max

CRUD (Teucrium WTI Crude Oil Fund) is the newest product among four on the market and also implies a strategy to reduce the effects of contango and backwardation by spreading exposure across multiple maturities, weighting holdings as follows:

- 35% weight to the nearest-to-spot June or December contract;

- 30% weight to the June or December contract following the aforementioned;

- 35% weight to the December contract that immediately follows the aforementioned.

Investing in the forward curve and sharply limiting portfolio turnover to twice a year the fund is designed to create the potential for better fund returns.

1 day

5 days

3 months

6 months

1 year

2 years

5 years

Max

Conclusion of Oil ETF Funds Comparison

Contango and rollover of futures have negative impact on ETFs and ETNs returns compared to spot crude oil price. You have to be aware of them before investing in any commodities ETF. You have to distinguish between ETFs and ETNs as well, to understand additional credit/counterparty risk ETNs are carrying. Taking everything into consideration, USO is probably the best choice to invest in between USO, DBO and OIL. However, we have to wait and see how the CRUD strategies of eliminating rollover impact work. If it will bring good results, it might be worth paying higher management fee for this ETF.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Disclaimer! The information contained in this article is not warranted to be accurate, complete or timely and Stocks-For-Beginners.com is not responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Stocks-For-Beginners.com is not an investment advisor, and any content published by Stocks-For-Beginners.com does not constitute individual investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. From time to time, issuers of exchange-traded products mentioned herein may place paid advertisements with Stocks-For-Beginners.com. All content on Stocks-For-Beginners.com is produced independently of any advertising relationships.

Back from Oil ETF Funds to Exchange Traded Fund

Back from Oil ETF Funds to Best Online Trading Site for Beginners home page