Best Mutual Fund - How to Select One?

Selecting the best mutual fund can be quite a challenging job since there are tons of mutual funds out there and they have different risks and rewards.

You should do a mutual fund research before any investment is made, to find the fund that fits your style among more than 10,000 in North America only. Each mutual fund has different risks and rewards; the higher the potential return, the higher the risk of loss. Please understand, that all funds have at least some level of risk; with financial investments it is never possible to diversify away all risk. And one more important thing to remember - there is no best mutual fund for all of us; what is the best for me, does not mecessarily mean that it is also the best for you.

Three Varieties of Mutual Funds

At the fundamental level, there are three varieties of mutual funds: Equity funds (stocks), Fixed-income funds (bonds) and Money market funds. All mutual funds are variations of these three asset classes. For example, while equity funds that invest in fast-growing companies are known as growth funds, equity funds that invest only in companies of the same sector or region are known as specialty funds.

This article will focus on finding the best mutual fund in equities group, as this is the largest category of mutual funds. But you can read more about Bond Mutual Fund or Money Market Investing in separate articles. Other types of funds, like close-end funds, index funds, Exchange Traded Fund, funds of funds, hedge funds and commodities funds are also reviewed in separate articles.

To The Top Of Best Mutual Fund

Investment Objective of Mutual Funds

Style Box - Graphical Representation of Mutual Fund's Investment Objectives

Finding the best mutual fund usually starts with selecting the broad group of mutual funds determined by their investment objective. General investment objective of all funds is long-term capital growth with some income. But since many different types of equities exist, also many different types of equity funds exist and they could have different investment objectives.

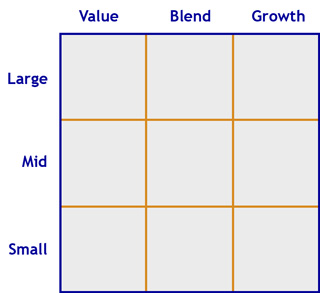

The simplest way to understand the universe of equity funds is to use a style box, which is a graphical representation of a mutual fund's characteristics and basically measures the size of the companies invested in and the investment style of the manager.

Size of the Companies in the Fund's Portfolio

Mutual funds differ among each other about the size of the companies they invest in. While majority of the funds invests in large-caps so that they avoid the liquidity problem, some of smaller mutual funds have specialized for investing in mid or even small-caps. These funds face some risk not common to large-cap investing, so normally they charge higher fees for managing their portfolios.

Value, Growth or Blend...

While the size of the companies invested in is self-explanatory, you should understand different possibilities of investment style which money manager is following. Value investment style refers to high quality companies that are fundamentally undervalued: low P/E and price-to-book ratios and high dividend yields. The opposite of value is growth investment style, which refers to companies that have had and are expected to continue to have strong growth in earnings, sales and cash flow. A compromise between value and growth is blend investment style, which simply refers to companies that are neither value nor growth stocks.

To The Top Of Best Mutual Fund

Global, Regional Or Specialty Mutual Funds

The next step in mutual fund research when selecting the best mutual fund is to check whether the fund's investments are global or focused on a special country or region.

Global Funds

Global funds invest internationally, anywhere around the world and this kind of diversification can with well balanced portfolio actually reduce the risk, although the world's economies are becoming more inter-related.

Regional Funds

On the other side, regional mutual funds are focused on a special country or region and have unique country and political risk influencing funds volatility. Purpose of this kind of funds is to make it easier to buy stocks in foreign countries, which can be otherwise difficult and expensive; you can focus on a specific area of the world, Asia without Japan for example, or only China as another example.

Specialty Funds

Specialty mutual funds don't necessarily belong to the categories we've described so far; their investment portfolio can be diversified broadly or concentrate on a certain segment of the economy. The majority of specialty funds refer to specific sectors of the economy such as financial, technology, health, etc. Sector funds can be extremely volatile; there is a greater possibility of big gains, but you have to accept that your sector may tank.

To The Top Of Best Mutual Fund

Expenses and Expense Ratios

Third and final step of selecting the best mutual fund is comparison of expenses between funds. This is an important factor to watch, since these costs eat into your return, and they are the main reason why the majority of funds end up with sub-par performance. Why focus on the costs side? Since in every fund prospect it is clearly written, that past performance is no guaranty for future performance, the only thing you can control in the time you take investment decision, are costs of the fund.

Mutual funds bear expenses similar to other companies. The fee structure of a mutual fund can be divided into two or three main components: management fee, non-management expense and other service fees. All expenses are expressed as a percentage of the average daily net assets of the fund.

Management Fee

The management fee consists of advisory fee and administrative fees; sometimes advisory fee and administrative fee are shown separately and in other times advisory fee can include administrative fee - this is something you must bear in your mind when comparing management fee components across multiple funds.

Non-Management Fee

Apart from the management fee, there are certain non-management expenses which most funds must pay. Some of the more significant are: transfer agent expenses (selling person), custodian expense (bank holding the fund's assets), legal/audit expense, accounting expense, registration expense to the SEC, board of directors/trustees expense (meetings fee), and printing and postage expense (shareholder reports).

Other Service Fees

Other service fees are related with marketing/shareholder servicing fees, investor fees and expenses and brokerage commissions.

To make comparison of funds easier and more transparent to investors, the fund's total expense ratio (TER) was adopted as a measure of the total cost of a fund; includes various fees and expenses. TER is calculated by dividing the total annual cost by the fund's total assets averaged over that year, and is denoted as a percentage. It will normally vary somewhat from year to year.

To The Top Of Best Mutual Fund

Finding the Best Mutual Fund - Conclusion

At the end of mutual fund research process, you will have to choose the fund family to trust your money to. Could be Vanguard, iShares... There are many out there. If you would like to make your life easy when searching for the best mutual fund, go to Morningstar website, where you will find many options to choose and filter from.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Where To Go Next?

Best Index Funds - Finding Your Favorite Choice

When it comes to finding best index funds, there is not a lot of things to compare about. They differ by fund's expenses and level of service provided.

Understanding Mutual Fund Prices

This article reveals which are the factors that determine mutual fund prices and how they are calculated.

Money Market Mutual Funds - Smart Investment or Stay Away?

There is a lot of money invested in money market mutual funds globally. Let's discover their advantages and reasons to or not to invest your money with them.

Back from Best Mutual Fund to Best Online Trading Site for Beginners home page